Paul B Insurance Medigap - Truths

Wiki Article

Paul B Insurance Medigap Can Be Fun For Everyone

Table of ContentsNot known Facts About Paul B Insurance MedigapFascination About Paul B Insurance MedigapPaul B Insurance Medigap for BeginnersPaul B Insurance Medigap Fundamentals ExplainedPaul B Insurance Medigap Fundamentals ExplainedWhat Does Paul B Insurance Medigap Do?

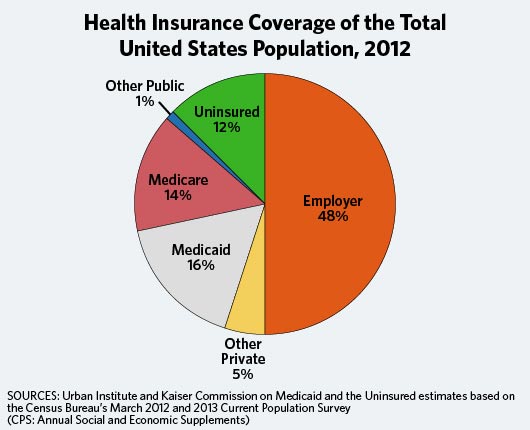

You have actually possibly discovered that Medicare is rather various from health and wellness insurance policy prepares you've had previously. Initial Medicare, or Medicare you obtain from the federal government, only covers medical and hospital advantages.

Some Known Factual Statements About Paul B Insurance Medigap

Medicare health insurance plan offer Part A (Healthcare Facility Insurance Policy) as well as Part B (Medical Insurance coverage) advantages to individuals with Medicare. These plans are generally supplied by private companies that contract with Medicare. They consist of Medicare Benefit Program (Component C) , Medicare Expense Plans , Presentations / Pilots, and Program of Extensive Take Care Of the Elderly (RATE) .1 As well as because you aren't ready to leave the workforce simply yet, you may have a brand-new alternative to take into consideration for your medical coverage: Medicare. This post contrasts Medicare vs.

The Ultimate Guide To Paul B Insurance Medigap

The difference between private in between exclusive health and wellness Insurance coverage is that Medicare is mostly for mainly Americans 65 and older and surpasses private health exclusive health and wellness insurance policy number of coverage choicesProtection selections private health exclusive wellness insurance policy permits dependents.

If you choose a Medicare mix, you can contrast those types of plans to discover the most effective premium and insurance coverage for your demands. Select a strategy mix that matches your needs, and after that see in-depth details about what each plan will cover. Start contrasting strategies currently. Original Medicare Original Medicare (Components An and also B) gives hospital and clinical insurance policy.

How Paul B Insurance Medigap can Save You Time, Stress, and Money.

Original Medicare + Medicare Supplement This combination adds Medicare Supplement to the fundamental Medicare insurance coverage. Medicare Supplement strategies are made to cover the out-of-pocket prices left over from Initial Medicare.This can decrease the cost of covered drugs. Medicare Advantage (with prescription medicine protection included) Medicare Advantage (Component C) strategies are often called all-in-one strategies. Along with Part An and also Part B insurance coverage, several Medicare Advantage strategies consist of prescription drug strategy protection. These plans likewise typically consist of dental, vision, and hearing insurance coverage.

Medicare is the front-runner when it comes to networks. If you don't desire to stick to a minimal number of physicians or health centers, Original Medicare is most likely your best choice.

The Facts About Paul B Insurance Medigap Revealed

These you could try these out places and individuals make up a network. If you make a check out outside of your network, unless it is an emergency, you will certainly either have restricted or no insurance coverage from your health insurance coverage plan. This can obtain expensive, particularly because it isn't always very easy for individuals to recognize which service providers as well as places are covered.

This is a location where your exclusive Affordable Treatment Act (ACA) or employer plan may beat Medicare. The ordinary month-to-month click here to read company costs is $108. 2 While many people will certainly pay $0 for Medicare Component A costs, the basic costs for Medicare Component B is $170. 10 in 2022. 3 Parts An and B (Initial Medicare) are the basic structure blocks for insurance coverage, and also delaying your registration in either can result in punitive damages.

These plans won't erase your Part B costs, however they can supply added protection at little to no charge. The rate that Medicare pays contrasted to personal insurance policy depends upon the services rendered, and also rates can vary. According to a 2020 KFF research, private insurance policy settlement rates were 1.

Excitement About Paul B Insurance Medigap

5 times more than Medicare rates for inpatient healthcare facility solutions. 4 The following thing you may take into look what i found consideration are your annual out-of-pocket costs. These consist of copays, coinsurance, as well as insurance deductible quantities. Medicare has utilize to discuss with doctor as a national program, while private medical insurance intends work out as private firms.

You must additionally take into consideration deductibles when looking at Medicare vs. exclusive health insurance policy. The Medicare Part An insurance deductible is $1,556.

It is best to use your plan information to make contrasts. On standard, a bronze-level health and wellness insurance coverage plan will certainly have an annual clinical insurance deductible of $1,730.

Report this wiki page